Search results : central bank

2026-01-31 10:31:00 Saturday ET

2025-02-27 07:24:00 Thursday ET

2026-07-01 11:29:00 Wednesday ET

2025-06-21 05:25:00 Saturday ET

2025-06-20 08:27:00 Friday ET

2025-06-13 08:23:00 Friday ET

2024-07-31 09:28:00 Wednesday ET

2023-12-08 08:28:00 Friday ET

2023-12-07 07:22:00 Thursday ET

2023-12-03 11:33:00 Sunday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2019-10-07 12:35:00 Monday ET

Federal Reserve reduces the interest rate by another key quarter point to the target range of 1.75%-2% in September 2019. In accordance with the Federal Res

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2025-10-08 11:34:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I

2019-08-31 14:39:00 Saturday ET

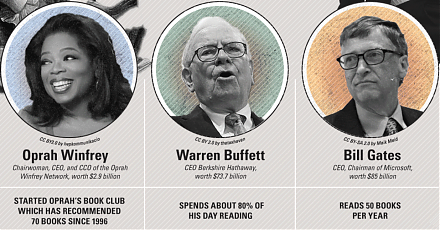

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B