2018-09-23 08:37:00 Sun ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Bank of America Merrill Lynch's chief investment strategist Michael Hartnett points out that U.S. corporate debt (not household credit supply or bank capital shortage) can cause the next financial crisis.

U.S. public corporations have gradually accumulated more than $6 trillion debt with low interest rates since the global financial crisis from 2008 to 2009. This corporate debt binge helps fund the recent recovery in new capital investment and equipment, full employment, and stock buyback in America.

Corporate default rates are minuscule, and U.S. companies now sit on hefty cash stockpiles primarily due to robust U.S. economic output gains and corporate tax cuts under the Trump administration. At some inflection point, however, economic growth and corporate income may start to slow down. U.S. companies then would have less firepower to pay back debt, and it is not easy for these companies to roll over their debt in due course. Debt-laden companies would be vulnerable to higher costs of capital as the Federal Reserve continues the current interest rate hike.

These high costs of capital can translate into a new corporate credit crunch, which adversely affects both employment and capital investment as the U.S. economy slides into an economic recession.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-20 07:33:00 Tuesday ET

The recent British pound depreciation is a big Brexit barometer. Britain appoints former London mayor and Foreign Secretary Boris Johnson as the prime minis

2019-12-01 10:31:00 Sunday ET

Goop Founder and CEO Gwyneth Paltrow serves as a great inspiration for female entrepreneurs. Paltrow designs Goop as an online newsletter, and this newslett

2019-09-19 15:30:00 Thursday ET

U.S. yield curve inversion can be a sign but not a root cause of the next economic recession. Treasury yield curve inversion helps predict each of the U.S.

2019-06-09 11:29:00 Sunday ET

St Louis Federal Reserve President James Bullard indicates that his ideal baseline scenario remains a mutually beneficial China-U.S. trade deal. Bullard ind

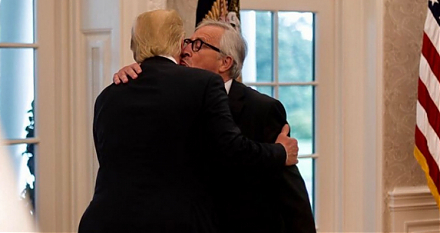

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2017-02-19 07:41:00 Sunday ET

In his recent book on personal finance, Tony Robbins recommends that each investor should rebalance his or her investment portfolio *only once a year* to in