2019-05-23 10:33:00 Thu ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French economist and author Thomas Piketty advocates that there is an innate tendency toward wealth concentration in most market economies where the nominal interest rate on capital investments well exceeds the economic growth rate. Former IMF chief economist Olivier Blanchard argues that the real interest rate on risk-free government bonds must be lower than the economic growth rate for most market economies to carry greater government debt with low inflation. Blanchard focuses on the real interest rate on low-risk government bonds, whereas, Piketty focuses on the nominal return on risky capital investments.

These interest rates diverge by a 5%-6% equity risk premium, which reflects how risk-averse the typical stock market investor is through the real business cycle. For Piketty, high wealth concentration can result from a large equity risk premium that calls for higher taxes on the rich. For Blanchard, the government can accumulate higher public debt as core CPI inflation remains moderate over time. On balance, Eichengreen supports greater fiscal deficit finance for health care, infrastructure, R&D, and social security as prices and asset premiums stabilize in recent times.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

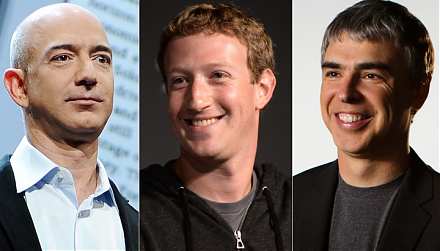

2018-11-19 09:38:00 Monday ET

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2017-01-23 09:30:00 Monday ET

There are several highlights from the first news conference after Trump's presidential election victory: The Trump administration will repeal-and-

2018-04-02 07:33:00 Monday ET

China President Xi JinPing tries to ease trade tension between America and China in his presidential address at the annual Boao forum. In his vulnerable att

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade

2020-07-12 08:30:00 Sunday ET

The lean CEO encourages iterative continuous improvements and collaborative teams to innovate around core value streams. Jacob Stoller (2015)

2017-05-19 09:39:00 Friday ET

FAMGA stands for Facebook, Apple, Microsoft, Google, and Amazon. These tech giants account for more than 15% of market capitalization of the American stock