2019-07-27 17:37:00 Sat ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance professor Jonathan Berk suggests, capital flows equilibrate persistent mutual fund returns relative to the stock market benchmarks. Since investors first direct capital to the best active mutual fund managers, these fund managers receive so much money that it affects their ability to generate superior returns. The average return declines to fit the average return for the second-best fund managers. At this stage, investors become indifferent to investing with the first-best and second-best fund managers, so capital flows equilibrate until their average return declines to match the average return for the third-best fund managers.

This process continues until the average return of investing in most active mutual funds declines to match the stock market benchmark. Capital flows can thus reflect persistent asset returns in the transition toward the dynamic equilibrium outcome. Only high-skill fund managers can consistently earn superior average returns when numerous fund managers compete for scarce capital flows. The rationale suggests that investors who choose to invest with active fund managers cannot expect to receive positive excess returns after we apply appropriate risk and fee adjustments.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-25 12:37:00 Sunday ET

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between

2022-02-25 00:00:00 Friday ET

Empirical tests of multi-factor models for asset return prediction The capital asset pricing model (CAPM) of Sharpe (1964), Lintner (1965), and Bla

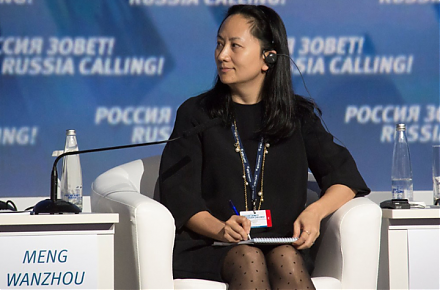

2018-12-13 08:30:00 Thursday ET

The recent arrest of HuaWei senior executive manager may upend the trade truce between America and China. At the request of several U.S. authorities, Canadi

2019-02-17 14:40:00 Sunday ET

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% rich

2017-01-03 03:26:00 Tuesday ET

President-Elect Donald Trump wants Apple and its tech peers to consider better and greater high-tech job creation in America. Apple has asked its primary

2018-11-05 10:40:00 Monday ET

Former Fed Chair Janet Yellen worries about U.S. government debt accumulation, expects new interest rate increases, and warns of the next economic recession