2019-08-05 13:30:00 Mon ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

China continues to sell U.S. Treasury bonds amid Sino-U.S. trade truce uncertainty. In mid-2019, China reduces its U.S. Treasury bond positions by $20.5 billion to $1.12 trillion. These Treasury bond positions reach their lowest level or 5% of U.S. government debt in 2017-2019 amid Sino-American trade conflict and economic policy uncertainty. The Chinese Xi administration may use its current status as the top Treasury debtholder as special leverage in the next round of trade negotiations. In response, the Chinese renminbi hovers in the broad range of 6.69x-6.97x per U.S. dollar during the recent time frame. Some investment bankers speculate that as the largest foreign owner of U.S. government bonds, China may implement the nuclear option by offloading lots of Treasury bonds to trigger interest rate hikes in America. These interest rate hikes may inadvertently cause collateral damage to the U.S. economy.

However, Lowy Institute senior fellow Richard McGregor offers the fresh economic insight that China cannot easily manipulate its current U.S. Treasury bond portfolio with no negative impact on the Chinese currency and current account deficit. U.S. trade envoy Robert Lighthizer and Treasury Secretary Steven Mnuchin expect to meet the Chinese hardliners for bilateral trade discussions in Shanghai from late-July to mid-August 2019.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-17 12:37:00 Wednesday ET

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider

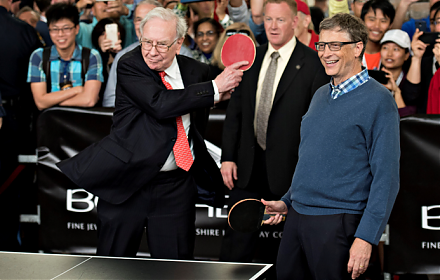

2017-11-13 07:42:00 Monday ET

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2018-11-05 10:40:00 Monday ET

Former Fed Chair Janet Yellen worries about U.S. government debt accumulation, expects new interest rate increases, and warns of the next economic recession

2019-10-13 16:22:00 Sunday ET

Apple unveils 3 iPhone 11 models with new original video services and stars such as Oprah Winfrey, Jennifer Aniston, and Reese Witherspoon. Apple releases t

2018-01-19 11:32:00 Friday ET

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation,

2019-04-27 16:41:00 Saturday ET

Tony Robbins suggests that one has to be able to make money during sleep hours in order to reach financial freedom. Most of our jobs and life experiences tr