2018-01-17 05:30:00 Wed ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

European Union antitrust regulators impose a fine on Qualcomm for advancing its key exclusive microchip deal with Apple to block out rivals such as Intel and TSMC. The European Commission takes into account Qualcomm's multi-year dominance in the LTE microchip market with rapid mobile broadband connections. In recent times, Qualcomm attempts to force Apple and its Asian upstream suppliers to use its trademark microchips exclusively in return for lower licensing fees.

Qualcomm can thus unfairly cut out intense competition in the LTE chipset market. In fact, Qualcomm pays billions of U.S. dollars to Apple such that it would not buy from other microchip producers.

These payments represent not just price reductions, but the primary condition that Apple would exclusively use Qualcomm's baseband chipsets in all its iPhones and iPads. Several other smart phone rivals such as Lenovo, OPPO, Vivo, and Xiaomi express an active interest in buying $2 billion Qualcomm chipsets over 3 years. No microchip rivals would be able to effectively challenge Qualcomm in this particular market regardless of product quality improvements.

The European Commission thus has to penalize Qualcomm for its anti-competitive market behavior. This E.U. regulatory decision has deep economic implications for Apple and other mobile device suppliers and manufacturers worldwide.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-11 07:44:00 Monday ET

Facebook, Apple, Amazon, Netflix, and Google (FAANG) have been the motor of the S&P 500 stock market index. Several economic media commentators contend

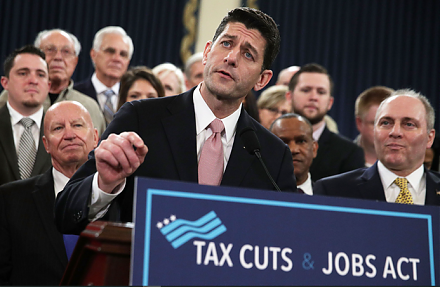

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2018-11-13 12:30:00 Tuesday ET

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese

2016-10-19 00:00:00 Wednesday ET

India's equivalent to Warren Buffett in America, Rakesh Jhunjhunwala, offers several key lessons for stock market investors: When the press o

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities

2022-11-05 11:32:00 Saturday ET

CEO overconfidence and corporate performance Malmendier and Tate (JFE 2008, JF 2005) argue that overconfident CEOs are more likely to initiate mergers an