2017-12-11 08:42:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

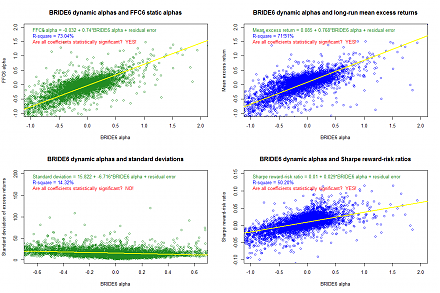

Fed Chair Janet Yellen says the current high stock market valuation does not mean overvaluation. A stock market quick fire sale would pose minimal risk to the economy and the macroprudential system. During her final Federal Reserve press conference, Yellen says the prime metrics such as the forward aggregate stock market P/E and P/B ratios are on the high end of historical ranges when the Fed warns that asset prices appear to be high. In fact, the low-interest-rate economic environment is supportive of higher stock prices and home prices. In this context, there is a reasonable balance of financial risks that manifest in the form of less worrisome levels of both bank leverage and private credit growth.

A recent Project Syndicate op-ed article sketches the key reasons for U.S. stock market rational exuberance such as better economic growth with low inflation, monetary and fiscal stimulus, full employment, and higher net income in both the household and corporate sectors. As the world economy skyrockets on all cylinders in America, Europe, and China with robust economic growth since the global financial crisis of 2008-2009, U.S. inflation remains below the 2% target, unemployment is less than 5%, and monetary policy normalization continues at a moderate pace. Federal Reserve shrinks its balance sheet post-QE, finishes the full course of 3 interest rate hikes in 2017, and then expects another around of 3 to 4 rate increases in 2018. The current 7-year uptick in U.S. corporate net income typically precedes the European and Asian counterparts in subsequent episodes. All of these reasons help justify the current Trump stock market rally as rational exuberance and optimism.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-08-26 10:33:00 Wednesday ET

Through purposeful leadership, senior managers inspire teams to reach heights of both innovation and profitability with great brand identity and customer lo

2019-05-15 12:32:00 Wednesday ET

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administ

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2019-08-09 18:35:00 Friday ET

Nobel Laureate Joseph Stiglitz maintains that globalization only works for a few elite groups; whereas, the government should now reassert itself in terms o

2019-06-21 13:33:00 Friday ET

Amazon and Google face more intense antitrust scrutiny. In recent times, Justice Department and Federal Trade Commission have reached an internal agreement

2018-03-19 10:37:00 Monday ET

Uber's autonomous car causes the first known pedestrian fatality from a driverless vehicle and thus sets off the alarm bell for artificial intelligence.