2019-09-07 17:37:00 Sat ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Federal Reserve Chair Jerome Powell announces the monetary policy decision to lower the federal funds rate by a quarter point to 2%-2.25%. This interest rate cut is the first rate reduction since December 2008. For most American investors, the rate cut can mean a reprieve in the average cost of capital. Powell reiterates that this interest rate reduction cannot be misconstrued as a one-time rate cut or the first in a series. Stock market analysts may view Federal Reserve monetary policy independence in a negative light as the FOMC approves the interest rate cut under pressure from a vocal president. The interest rate cut sends a shiver through global markets, and the intricate nuances of Powell language reverberate in response to persistently low inflation in America.

Powell faces direct and confrontational questions on why a rate cut is necessary when the U.S. economy remains robust with high employment. The current U.S. inflation rate hovers in the reasonable range of 1.5%-1.7% below the 2% monetary policy target, and the current U.S. unemployment rate persists at 3.7% per annum. The recent interest rate cut may inadvertently limit the Federal Reserve monetary policy adjustments in response to a future financial downturn.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

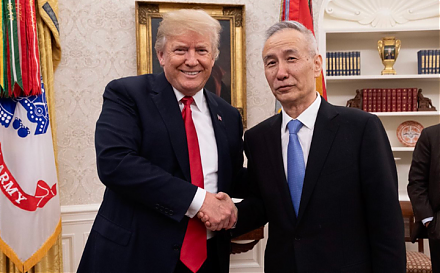

2018-06-09 16:40:00 Saturday ET

The Trump administration introduces new tariffs on $50 billion Chinese goods amid the persistent bilateral trade dispute. The tariffs effectively boost cost

2020-09-11 10:22:00 Friday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools. In recent times, we have completed our fresh website up

2022-03-15 10:32:00 Tuesday ET

Capital structure theory and practice The genesis of modern capital structure theory traces back to the seminal work of Modigliani and Miller (1958

2019-11-05 07:41:00 Tuesday ET

The Trump administration expects to reach an interim partial trade deal with China. This interim partial trade deal represents the first phase of a comprehe

2018-09-27 11:41:00 Thursday ET

Michael Kors pays $2.3 billion to acquire the Italian elite fashion brand Versace. In accordance with Michael Kors's 5-year plan, the joint company grow

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin