2019-01-08 17:46:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House. There are at least 3 root causes of the key neutral interest rate hike. First, the real interest rate is remarkably low around the zero lower bound when the CPI inflation rate is about 2.2% and the U.S. federal funds rate lands in the target range of 2%-2.25%. This near-zero real rate can cause serious problems. For instance, firms respond to the low cost of capital by taking on excessive debt. Banks reach for higher yields by lending to high-risk borrowers with some deterioration in underwriting standards. Institutional investors can lever up to boost stock market indices to unsustainably high levels. The government tends to run fiscal deficits because the debt-servicing cost is relatively low. Such aggregate credit supply changes can sow the seeds of the next economic recession.

Second, the Federal Open Market Committee (FOMC) can normalize the current interest rate hike such that the central bank gains greater instrumental bandwidth to deal with the next financial downturn. At subsequent stages of the real business cycle, the FOMC can then apply downward interest rate adjustments as the neutral interest rate allows the U.S. economy to operate near full employment with inflation containment. The current U.S. unemployment is 3.7%, and the FOMC expects the long-term sustainable unemployment rate to be about 4.4%. In the rosy picture of 3%-3.5% real GDP economic growth, the FOMC has to gradually introduce interest rate increases to prevent 2% CPI inflation from becoming an economic disturbance.

In light of one rate increase per quarter throughout 2018, the FOMC expects to raise the interest rate twice in 2019.

Third, the Federal Reserve now needs to normalize the current interest rate hike to signal its own monetary policy independence from the White House. Empirical evidence shows that monetary policy independence helps better curb inflation with steady gains in productivity growth, capital investment, and domestic employment. Fed Chair Jerome Powell needs to continue interest rate increases to attain a fair trade-off between inflation and unemployment (although Powell receives several criticisms from President Trump in recent times).

Overall, the Federal Reserve has to maintain the current hawkish monetary policy pace in response to multiple economic headwinds from Trump tax cuts and tariffs to higher public expenditures and health care costs.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-11-07 11:31:00 Tuesday ET

Joel Mokyr suggests that economic growth arises from a change in cultural beliefs toward technological progress. Joel Mokyr (2018) A culture

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance

2018-11-07 08:30:00 Wednesday ET

PwC releases a new study of top innovators worldwide as of November 2018. This study assesses the top 1,000 global companies that spend the most on R&D

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2017-05-01 09:45:00 Monday ET

Apple now pursues an early harvest strategy that focuses on extracting healthy profits from a relatively static market for the Mac, iPhone, and iPad, all of

2017-08-01 09:40:00 Tuesday ET

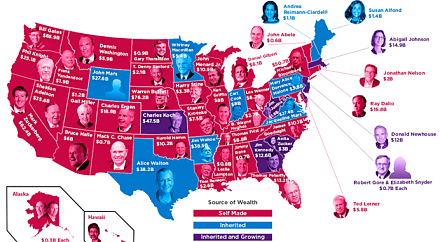

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N