2018-01-21 07:25:00 Sun ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns asset bubbles in the American stock and bond markets in early-2018. Despite the recent healthy fundamental recalibration, Greenspan warn of high U.S. stock indices from Dow and S&P 500 to NASDAQ and Fortune 500. Also, Greenspan points out that the current government bond yields hover not far from historically low thresholds. The latter may transform into potential U.S. bond yield curve inversion, which often signals the early dawn of an economic recession. This inversion correctly predicts U.S. economic downturns in all decades after the 1960s. As the Federal Reserve gradually normalizes and tightens its core monetary policy, interest rates continue to raise the relative likelihood of bond yield curve inversion. Greenspan shares his ingenious insight that higher long-term government bond yields may determine the extent and duration of bullish investor sentiments during the current interest rate hike. Whether the Trump team addresses the fiscal gap with $2 trillion government expenditures and $1.5 trillion tax cuts depends on the future U.S. real GDP growth trajectory. The Trump administration expects 3%-3.5% real GDP economic growth for this self-finance to trickle down to the typical American. Greenspan's prescient comments warn of the current fiscal shortfall that may fuel U.S. debt escalation as a proportion of total real GDP.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-25 12:43:00 Monday ET

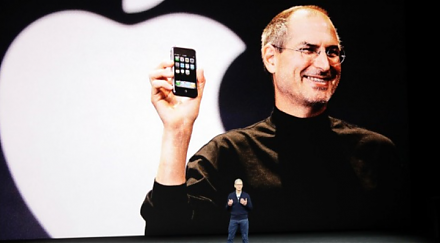

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su

2018-05-13 08:33:00 Sunday ET

Incoming New York Fed President John Williams suggests that it is about time to end forward guidance in order to stop holding the financial market's han

2019-10-17 08:35:00 Thursday ET

The European Central Bank expects to further reduce negative interest rates with new quantitative government bond purchases. The ECB commits to further cutt

2020-11-22 11:30:00 Sunday ET

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2019-06-05 10:34:00 Wednesday ET

Fed Chair Jay Powell suggests that the recent surge in U.S. business debt poses moderate risks to the economy. Many corporate treasuries now carry about 40%