2019-08-22 11:35:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Fundamental factors often reflect macroeconomic innovations and so help inform better stock investment decisions. Nobel Laureate Eugene Fama and his long-time co-author Ken French empirically find that several fundamental factors help price the cross-section of average asset returns. These fundamental factors include the return spreads between the top-and-bottom stock portfolios that the analyst sorts on size, value, momentum, asset growth, profitability, and market risk exposure.

In terms of stock market capitalization, small stocks often outperform large stocks by a significant 5%-7% factor premium. Value stocks can consistently beat glamour stocks by a 7%-9% factor premium. Furthermore, investors can earn hefty average returns on stocks with high recent share price performance, low capital-intensive asset growth, high cash profitability, and low market risk exposure (beta arbitrage). AQR Capital investment practitioners show that both value and momentum factor premiums significantly persist in global asset markets. To the extent that key factor premiums exhibit mutual causation with macroeconomic surprises, this causation serves as a new condition for fundamental factor selection. As investors learn from their behavioral biases, quirks, and other investment mistakes, these investors tilt their asset portfolios toward high factor premiums. This factor investment approach helps generate consistent supernormal asset returns in the long run.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-03 10:40:00 Monday ET

Bank of England publishes its latest insights into the economic impact of Brexit on British real productivity, capital investment, and labor supply as of 20

2018-01-07 09:33:00 Sunday ET

Zuckerberg announces his major changes in Facebook's newsfeed algorithm and user authentication. Facebook now has to change the newsfeed filter to prior

2018-06-14 10:35:00 Thursday ET

The Federal Reserve's current interest rate hike may lead to the next economic recession as credit supply growth ebbs and flows through the business cyc

2018-11-09 11:35:00 Friday ET

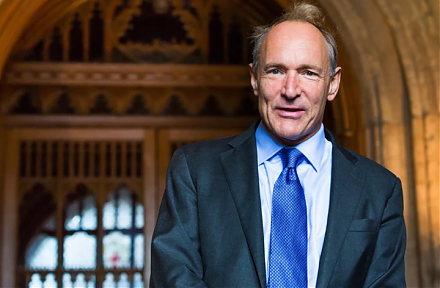

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2019-06-25 10:34:00 Tuesday ET

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the a

2020-10-13 08:27:00 Tuesday ET

Agile lean enterprises strive to design radical business models to remain competitive in the face of nimble startups and megatrends. Carsten Linz, Gunter