2018-01-02 12:39:00 Tue ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Goldman Sachs takes a $5 billion net income hit that results from its offshore cash repatriation under the new Trump tax law. This income hit reflects 10%-15% tax payments that each large bank can spread over 8 years. Citigroup also expects to experience a temporary $20 billion net income hit due to offshore cash repatriation while Bank of America expects a similar one-time $3 billion net income hit. Several other banks such as JPMorgan Chase and Wells Fargo are likely to receive similar preferential treatment under the Trump tax holiday. This preferential tax treatment allows most financial institutions to repatriate offshore cash stockpiles to invest in domestic job creation, R&D innovation, and capital equipment usage.

In effect, the Trump tax holiday empowers multinational banks to experience short-term pains in exchange for long-term gains under the territorial tax system. This new tax law is a major legislative victory for the Trump administration with strong support from Republicans over the joint opposition of Democrats. The recent ripple effects apply not only to key multinational banks but also multinational corporations (especially tech titans such as Facebook, Apple, Microsoft, Google, and Amazon). Overall, the medium-to-long-term tax cuts can continue to extend the Trump stock market rally.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-13 12:30:00 Tuesday ET

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese

2018-12-17 08:43:00 Monday ET

Apple files an appeal to overturn the recent iPhone sales ban in China due to its patent infringement of Qualcomm proprietary technology. This recent ban of

2018-09-23 08:37:00 Sunday ET

Bank of America Merrill Lynch's chief investment strategist Michael Hartnett points out that U.S. corporate debt (not household credit supply or bank ca

2025-10-11 14:33:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-05-19 09:39:00 Friday ET

FAMGA stands for Facebook, Apple, Microsoft, Google, and Amazon. These tech giants account for more than 15% of market capitalization of the American stock

2025-06-28 10:39:00 Saturday ET

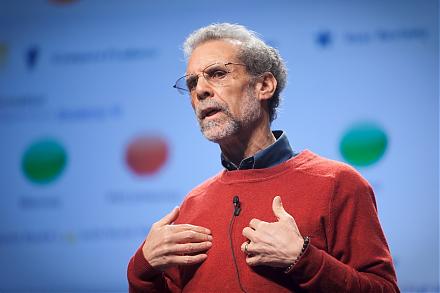

Former New York Times science author and Harvard psychologist Daniel Goleman explains why great mental focus serves as a vital mainstream driver of personal