2017-11-07 09:38:00 Tue ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

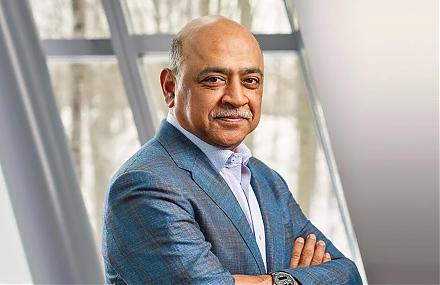

HPE CEO Meg Whitman has run both eBay and Hewlett Packard within Fortune 500 and now has decided to step down after her 6-year stint at the technology giant. As one of the most prestigious women in Corporate America and a former candidate for California governor, Whitman split Hewlett Packard Corporation into HPE and PC-and-printer business HP Inc back in 2015 as part and parcel of an ambitious plan to turn around the large conglomerate. She aggressively shed assets and cut tens of thousands of jobs as HPE sharpened its focus on cloud server and network businesses. HPE share prices have risen by a margin of 47% in stark contrast to a bullish 27% return on S&P 500 in the same period.

At HPE, Whitman's tenure set a healthy sequence of corporate reorganizations that she regarded as necessary to focus on the core businesses. For instance, Whitman rubber-stamped several complex deals of spinning off HP's software business to British tech firm Micro Focus, as well as spinning off HP's IT service business to DXC Technology. During Whitman's tenure, HPE further unloaded its Indian IT outsourcing unit Mphasis to the Blackstone Group.

Whitman's HPE adventures represent a classic business case study of valuable aggressive corporate reorganizations that reorient the essential core assets of a tech conglomerate. This landmark case study sheds fresh light on successful corporate reorganizations for business executives and stock market investors to focus on more sustainable firm valuation and shareholder wealth creation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-01-08 08:25:00 Wednesday ET

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general electi

2018-06-11 07:44:00 Monday ET

Facebook, Apple, Amazon, Netflix, and Google (FAANG) have been the motor of the S&P 500 stock market index. Several economic media commentators contend

2019-09-11 09:31:00 Wednesday ET

Central banks in India, Thailand, and New Zealand lower their interest rates in a defensive response to the Federal Reserve recent rate cut. The central ban

2025-10-11 14:33:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2017-11-07 09:38:00 Tuesday ET

HPE CEO Meg Whitman has run both eBay and Hewlett Packard within Fortune 500 and now has decided to step down after her 6-year stint at the technology giant