2019-09-01 10:31:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Most artificial intelligence applications cannot figure out the intricate nuances of natural language and facial recognition. These intricate nuances represent a major persistent challenge to most recent artificial intelligence applications such as Apple Siri, Amazon Alexa, and Google Assistant etc. For instance, artificial intelligence applications often cannot decipher puns, jokes, sarcastic remarks, and other more complex conversations. Artificial intelligence applications often cannot distinguish delicate human facial expressions such as surprise and confusion, fear and anxiety, or hubris and hysteria.

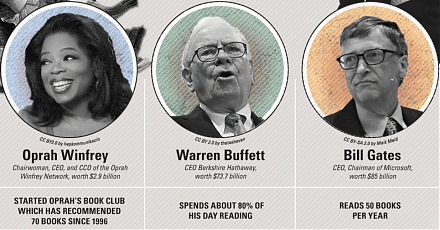

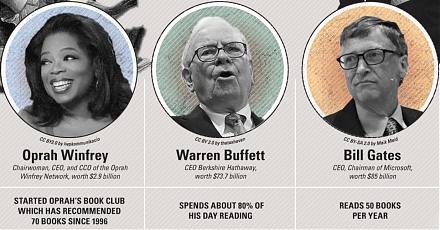

Many artificial intelligence machines learn from big data to predict specific human emotions, actions, and interactive outcomes via neural networks. Primary emotion recognition technology analyzes facial expressions to infer how humans feel, and this technology can create $25 billion business opportunities by 2025. Tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (F.A.M.G.A.) lead these tech advances in artificial intelligence. New lean specialty startups such Kairos and Affectiva also take part in this fresh unique direction. Emotion recognition can often help promote products and services, and this new technology can be useful in job recruitment, fraud, and crime prevention. Several lean enterprises seek to capture this tech niche, and these enterprises have yet to close the gap between artificial intelligence and universal intelligence.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-30 07:33:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube September 2019 In this podcast, we discuss several topical issues as of September 2019: (1) Former

2017-12-03 08:37:00 Sunday ET

Sean Parker, Napster founder and a former investor in Facebook, has become a "conscientious objector" on Facebook. Parker says Facebook explo

2019-06-29 17:30:00 Saturday ET

Nobel Laureate Joseph Stiglitz proposes the primary economic priorities in lieu of neoliberalism. Neoliberalism includes lower taxation, deregulation, socia

2018-05-10 07:37:00 Thursday ET

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2019-09-11 09:31:00 Wednesday ET

Central banks in India, Thailand, and New Zealand lower their interest rates in a defensive response to the Federal Reserve recent rate cut. The central ban