2018-01-19 11:32:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation, healthy fundamental recalibration, job creation, high productivity, and artificial-intelligence automation. For instance, the U.S. economy operates near full employment with 1.5%-2% moderate inflation, $2.5 trillion mandatory government expenditures, and $1.5 trillion tax cuts. Also, Europe now feels the benign effects of easy money that arises from the European Central Bank's (ECB) quantitative-easing and negative-interest-rate monetary policies. Asian economies such as Hong Kong, Singapore, South Korea, and Taiwan experience economic revival due to the global upstream prosperity of Apple-and-Samsung-driven mobile device production.

Key recent oil price increases boost economic gains for Russia, Saudi Arabia, and other middle-east producers. Meanwhile, Brazil still suffers the ripple effects of a veritable depression and now flashes tentative signs of macroeconomic recovery with high population dividends.

However, several other economies exhibit weak macro momentum with chaotic bouts of economic policy uncertainty. England now has to confront high unstable exchange rates, wide stock market gyrations, and trade barriers in the post-Brexit investment horizon. China may land hard with sub-6% real GDP economic growth due to the potential Sino-American trade war. Mexico may fail to transcend fears and doubts that the Trump team menaces its recent economic convalescence with hefty tariffs and border taxes.

The International Monetary Fund (IMF) predicts 2.7%-3% U.S. real GDP economic growth and 3.7%-3.9% economic growth worldwide. IMF research now warns of economic inequality, cybersecurity, extreme weather, and political confrontations such as U.S.-Korean nuclear threats and fair trade barriers.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-02-05 10:28:00 Wednesday ET

Our proprietary AYA fintech finbuzz essay shines light on the modern collection of business insights with executive annotations and personal reflections. Th

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2018-06-04 08:38:00 Monday ET

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's

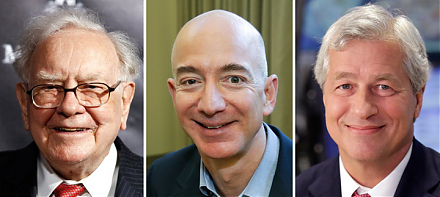

2018-01-23 06:38:00 Tuesday ET

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2018-03-02 12:34:00 Friday ET

White House top economic advisor Gary Cohn resigns due to his opposition to President Trump's recent protectionist decision on steel and aluminum tariff