2018-08-09 16:36:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

President Trump applies an increasingly bellicose stance toward the Iranian leader Hassan Rouhani as he rejects a global agreement to curb Iran's nuclear program. As Trump withdraws from the previous multilateral Iran nuclear deal, the U.S. plans to carry out its next implementation of stringent economic sanctions on Iran in late-2018. The Trump administration appears to apply the same strategy of draconian economic sanctions on North Korea to the Iran-U.S. nuclear negotiations. Rouhani consequently threatens to disrupt global oil shipments through the Strait of Hormuz, which serves as a strategic waterway for oil exports from the middle east.

Numerous stock market experts and pundits point out that the world would witness a sharp spike in oil prices toward $90-$100 per barrel if Iran decides to shut down the trade route. As one of the Top 5 oil supply countries, Iran may adversely affect the global energy transmission and deployment. An oil price spike often translates into higher costs of both consumption and production.

Higher inflation then induces central banks to raise interest rates to better balance the inexorable trade-off between price stability and employment. From a pragmatic perspective, the resultant energy price increases render international monetary policies less effective due to greater cost gyrations.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-09 11:35:00 Friday ET

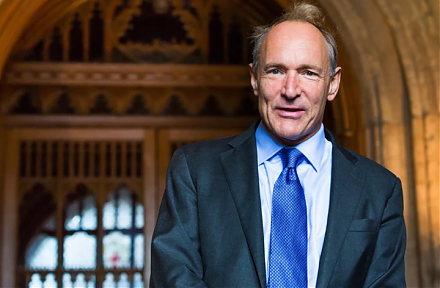

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2019-04-01 08:28:00 Monday ET

OraSure and its subsidiary DNA Genotek specialize in the lean production of home DNA spit tubes. OraSure extracts core genetic information from microbiome s

2018-07-21 13:35:00 Saturday ET

President Trump supports a bipartisan bill or the Foreign Investment Risk Review Modernization Act (FIRRMA), which effectively broadens the jurisdiction of

2018-05-03 07:34:00 Thursday ET

Sprint and T-Mobile propose a major merger in order to better compete with AT&T and Verizon. This mega merger is worth $26.5 billion and involves an all

2017-02-01 14:41:00 Wednesday ET

President Trump refreshes his public image through his presidential address to Congress with numerous ambitious economic policies in order to make America g

2021-11-22 11:29:00 Monday ET

U.S. judiciary subcommittee delves into the market dominance of online platforms in terms of the antitrust, commercial, and administrative law in America.