2017-12-03 08:37:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Sean Parker, Napster founder and a former investor in Facebook, has become a "conscientious objector" on Facebook. Parker says Facebook exploits human psychological vulnerabilities through positive validation that induces its users to constantly post to get more likes and more comments. This instant gratification is quick and easy but offers very few substantive insights and deep relationships.

Chamath Palihapitiya, a former vice president for Facebook user growth, points out that the short-term "dopamine-driven feedback loops" may destroy how our modern society works in practice. When millennials push the iconic "like" button, comment on specific posts, and share them on Facebook, these users reinforce their own views and opinions in virtual echo chambers. Palihapitiya says Face-book may erode "the core foundations of how people behave" in reality. He feels "tremendous guilt" about helping create social network tools and programs that may be "ripping apart the social fabric".

Public sentiment turns quite a bit against Facebook in light of the public issues around fake news and pervasive Russian posts on the U.S. presidential election in 2016. However, Mark Zuckerberg has refined the social mission of Facebook in order to give its active users the power to build interdependent communities so that the world becomes closer together. On this brighter side, social media networks such as Facebook, Twitter, LinkedIn, and so on play an important role in connecting all global citizens to better serve the key valuable purpose of life.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-06-03 05:35:00 Saturday ET

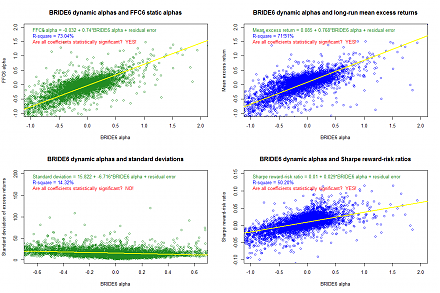

Fundamental value investors, who intend to manage their stock portfolios like Warren Buffett and Peter Lynch, now find it more difficult to ferret out indiv

2023-10-21 11:32:00 Saturday ET

Walter Scheidel indicates that persistent European fragmentation after the collapse of the Roman Empire leads to modern economic growth and development.

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2023-04-21 12:39:00 Friday ET

Angus Deaton analyzes the correlation between health and wealth in light of the economic origins of inequality worldwide. Angus Deaton (2015)

2022-05-15 10:29:00 Sunday ET

Innovative investment theory and practice Corporate investment can be in the form of real tangible investment or intangible investment. The former conce

2019-11-17 14:43:00 Sunday ET

New computer algorithms and passive mutual fund managers run the stock market. Morningstar suggests that the total dollar amount of passive equity assets re