2018-08-15 14:40:00 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Senator Elizabeth Warren advocates the alternative view that most U.S. trade deals serve corporate interests over workers, customers, and suppliers etc. She then introduces her new bill, the Accountable Capitalism Act, which would require large public corporations to consider the key interests of stakeholders in corporate decisions. If U.S. Congress passes this bill, large public corporations with more than $1 billion sales revenue would need to apply for a corporate charter from the federal government. These corporations would effectively have to become benefit corporations, or b-corps, in order to recognize the fact that their key fiduciary duties extend beyond shareholder wealth maximization.

Also, employees would be able to elect 40% of the board members (in the similar form of German co-determination), and top management would have to hold equity stakes for 5 years (or 3 years if a benign share buyback takes place). At least a 75% super-majority of both board members and shareholders would have to vote before the company make productive use of internal funds for political purposes.

In light of stark economic inequality, worker welfare, and corporate involvement in political affairs, the Accountable Capitalism Act helps address key socioeconomic issues in Corporate America. Senator Warren's provisos help tackle the complex perennial problem that many U.S. public corporations fixate on short-term stock price performance. As senior management often attempts to maximize short-term profits, obscene executive compensation reflects low performance-pay sensitivity to the detriment of stakeholders such as employees, customers, and suppliers etc.

Under the new legislation, CEOs, directors, and all other executive officers would need to fulfill their fiduciary duties of care, loyalty, and good faith in order to honor longer-term stakeholder value optimization. When push comes to shove with no perfunctory compliance exercises, it is key for these U.S. large public corporations to take into account not only shareholder interests but also the primary interests of all major stakeholders over the long run.

Jeffrey Miron, Harvard director of undergraduate studies, warns that this legislation would give the federal government excessive control over U.S. public corporations. In comparison to the top-down rule, Miron proposes relying on socially-responsible funds as a better market mechanism to tame U.S. large public corporations.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-04-07 13:39:00 Sunday ET

CNBC news anchor Becky Quick interviews Warren Buffett in early-2019. Buffett explains the fact that book value fluctuations are a metric that has lost rele

2017-12-01 06:30:00 Friday ET

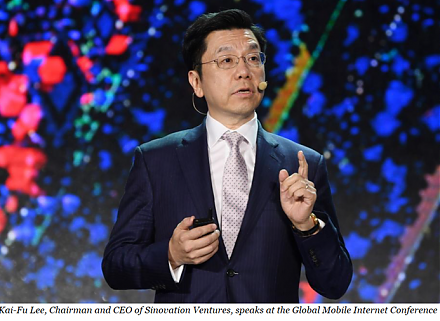

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2018-05-10 07:37:00 Thursday ET

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2018-11-05 10:40:00 Monday ET

Former Fed Chair Janet Yellen worries about U.S. government debt accumulation, expects new interest rate increases, and warns of the next economic recession