2019-07-09 15:14:00 Tue ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies to raise funds as the stock exchange criteria are less stringent than other domestic boards. In recent years, the Chinese government encourages local tech firms to become more self-reliant in producing microchips and other core components. This new star board arises amid the current Sino-American trade escalation and recent U.S. embargo on the HuaWei supply chain of electronic imports.

As of mid-2019, the new star board has received applications from 122 tech firms. Tech companies with at least RMB$300 million ($43 million) net income can list on the new star board insofar as these companies maintain the minimum stock market capitalization of RMB$2 billion with RMB$100 million cash flows in the prior 3 years. The board is the first registration-driven IPO system that streamlines price flotation restrictions. Like Facebook, Google, Alibaba, and JD etc, Chinese tech companies with a dual-class shareholding structure are eligible to apply for public registration. Alibaba has to mull over its recent proposal to list on Hong Kong Stock Exchange several years after its blockbuster IPO on NYSE.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-25 12:37:00 Sunday ET

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2020-03-05 08:28:00 Thursday ET

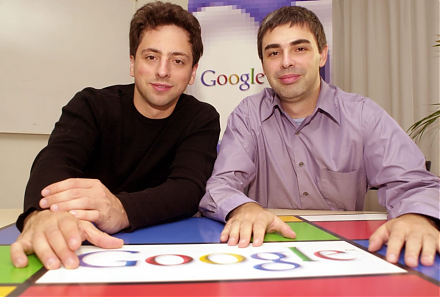

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2019-01-07 18:42:00 Monday ET

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on go

2018-03-06 11:35:00 Tuesday ET

The Trump team blocks Broadcom's bid for Qualcomm due to national economic security concerns and 5G telecom network issues. Broadcom makes microchips fo

2018-06-07 10:36:00 Thursday ET

AT&T wins court approval to take over Time Warner with a trademark $85 billion bid despite the Trump administration prior dissent due to antitrust conce