2019-08-02 17:39:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The Phillips curve becomes the Phillips cloud with no inexorable trade-off between inflation and unemployment. Stanford finance professor John Cochrane disagrees with Harvard macro economist Gregory Mankiw with respect to the mysterious and inexorable trade-off between inflation and unemployment. It is difficult to depict a key downward Phillips curve for the post-war period because there is no conclusive trade-off between inflation and unemployment. This empirical result remains true even when we consider alternative measures of U.S. inflation such as the deflator for personal consumption expenditures (PCE) and core consumer price index (CPI) inflation less food and energy. Furthermore, the empirical result continues to hold in practice when we consider the economic output gap in lieu of the unemployment rate. Cochrane suggests no clear trade-off between inflation and unemployment in the Phillips cloud. In other words, the Phillips curve is too flat to be true.

This analysis poses a conceptual challenge to New Keynesians who seek to attain the Federal Reserve dual mandate of both price stability and maximum sustainable employment. The central bank can constrain money supply growth as a potential source of economic disturbance; yet, the long-term welfare cost of low inflation has no real impact on economic output, employment, and capital investment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-01-03 03:26:00 Tuesday ET

President-Elect Donald Trump wants Apple and its tech peers to consider better and greater high-tech job creation in America. Apple has asked its primary

2023-11-21 11:32:00 Tuesday ET

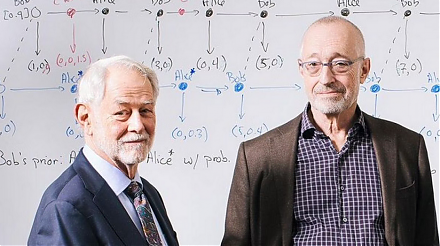

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on

2022-10-25 11:31:00 Tuesday ET

Corporate investment insights from mergers and acquisitions Relative market misvaluation between the bidder and target firms drives most waves of mergers

2019-07-01 12:35:00 Monday ET

Apple releases the new iOS 13 smartphone features. These features include Dark Mode, Audio Share, Memoji, better privacy protection, smart photo collection,

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.