2019-06-03 11:31:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

The Sino-U.S. trade war may be the Thucydides trap or a clash of Caucasian and non-Caucasian civilizations. The proverbial Thucydides trap refers to the historical fact that the dominant superpowers may experience inevitable economic sanctions (or even military confrontations) as these countries become more powerful in the world. The current Sino-U.S. trade conflict may result in the self-fulfilling prophecy that the incumbent American superpower fights fears of losing global dominance by precipitating a tit-for-tat trade war against its most plausible Chinese challenger.

In accordance with what Harvard political scientist Samuel Huntington suggests, the dominant superpowers may inadvertently go through the clash of civilizations. In the current Sino-U.S. trade war, China and the U.S. may have fallen into the Thucydides trap or an aggressive clash of Chinese and Caucasian civilizations. In fact, the Trump administration advocates *America First* trade protectionism with ubiquitous domestic populist support, whereas, the Chinese Xi administration calls for free markets and open trade flows. U.S. trade regulators should help curtail the imminent Chinese threat to international institutions such as WTO rules and other fair trade practices. The Trump administration must thus demonstrate that a higher moral purpose motivates U.S. protectionist trade policies if the Trump team intends to garner wider international support.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-02-14 09:31:00 Tuesday ET

Eric Posner and Glen Weyl propose radical reforms to resolve key market design problems for better democracy and globalization. Eric Posner and Glen Weyl

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an

2018-05-11 09:37:00 Friday ET

OPEC countries have cut the global glut of oil production in recent years while the resultant oil price has surged from $30 to $78 per barrel from 2015 to 2

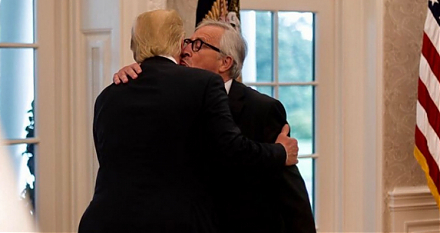

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2019-08-18 11:33:00 Sunday ET

House Judiciary Committee summons senior executive reps of the tech titans to assess online platforms and their market power. These companies are Facebook,

2025-10-13 12:32:00 Monday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund