2018-11-27 10:37:00 Tue ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Warren Buffett offloads a few stocks from the Berkshire Hathaway portfolio in mid-November 2018. The latest S.E.C. report shows that the Oracle of Omaha sold a significant number of shares in Phillips 66, Sanofi, Walmart, and 3 primary airlines: American Airlines, United Continental Airlines, and Southwest Air.

Berkshire unloads Phillips 66 shares as the oil refinery company hovers around the 10-year high share price. Buffett exercises discipline to sell Sanofi shares when the global biopharma company faces the patent expiration for its long-active insulin Lantus (which raked in $7 billion in annual revenue at its peak). Intense competition also arises for Sanofi in the wide context of both cancer and rare disease treatment.

Berkshire has continued to lower its stock bets on Walmart since 2016, and Buffett regrets his tough judgment call between the brick-and-mortar retailer Walmart and the ecommerce tech titan Amazon. Walmart has not been able to deter Amazon from acquiring its market share, and the Sino-U.S. trade disputes and higher U.S. wages can become detrimental to both sales and net profit margins for Walmart. For these reasons, Berkshire offloads the additional 1.4 million shares in Walmart. Buffett further trims the Berkshire stock bets on several airlines below the 10% disclosure threshold in order to avoid onerous regulatory compliance requirements.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-23 11:32:00 Wednesday ET

Higher public debt levels, global interest rate hikes, and subpar Chinese economic growth rates are the major risks to the world economy from 2019 to 2020.

2018-09-23 08:37:00 Sunday ET

Bank of America Merrill Lynch's chief investment strategist Michael Hartnett points out that U.S. corporate debt (not household credit supply or bank ca

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2019-02-05 10:32:00 Tuesday ET

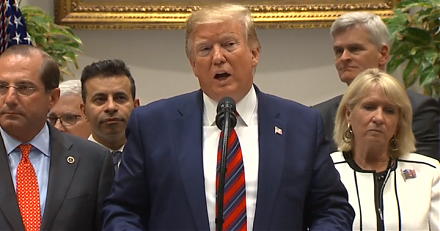

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now s

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2019-09-05 09:26:00 Thursday ET

Yale macro economist Stephen Roach draws 3 major conclusions with respect to the Chinese long-run view of the current tech trade conflict with America. Firs