2018-03-02 12:34:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

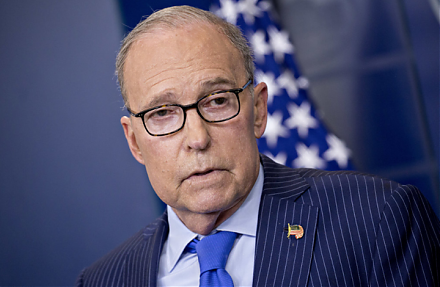

White House top economic advisor Gary Cohn resigns due to his opposition to President Trump's recent protectionist decision on steel and aluminum tariffs. The steel and aluminum tariffs target Canada, Europe, Mexico, and China. Key western allies may receive interim exemptions on a case-by-case basis. Through the abrupt tariff tactic, President Trump seeks to dramatically reduce U.S. trade and budget deficits for better mid-term election results.

The former Goldman Sachs president had strongly opposed trade barriers such as tariffs, quotas, and even embargoes. Cohn serves as a steady man in the White House and tries to push President Trump away from some of his most aggressive instincts on trade. In fact, Cohn would prefer the U.S. to keep the North American Free Trade Agreement (NAFTA).

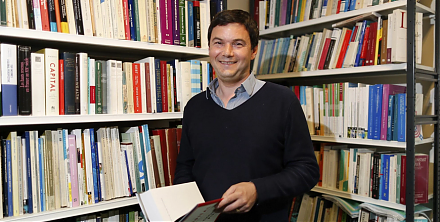

As a proponent of international free trade, Cohn would support the U.S. to join the Trans-Pacific Partnership (TPP). These international free trade movements reflect the collective wisdom of cross-border interests and efforts for fewer trade frictions. CNBC economic media commentator Larry Kudlow is likely to succeed Cohn as the Director of the National Economic Council. Kudlow tends to defend the Trump administration's gradual tariff tactics against China, Canada, Europe, and Mexico.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-03-14 16:43:00 Tuesday ET

Several feasible near-term reforms can substantially narrow the scope for global tax avoidance by closing information loopholes. Thomas Pogge and Krishen

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an

2024-07-31 09:28:00 Wednesday ET

In the modern monetary system, each new CBDC helps anchor public trust in money in support of economic welfare, especially in a cashless society. In our

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2017-05-13 07:28:00 Saturday ET

America's Top 5 tech firms, Apple, Alphabet, Microsoft, Amazon, and Facebook have become the most valuable publicly listed companies in the world. These

2018-09-23 08:37:00 Sunday ET

Bank of America Merrill Lynch's chief investment strategist Michael Hartnett points out that U.S. corporate debt (not household credit supply or bank ca