2018-12-01 11:37:00 Sat ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

As the solo author of the books Millionaire Next Door and Richer Than Millionaire, William Danko shares 3 top secrets for *better wealth creation*. True prosperity is the convergence of good health, wealth, and happiness. The median net worth of self-made millionaires is $2.3 million, and their median age is 50. Most millionaires are men (90%) and also live in happy marriages (93%). First, most wage-earners should save 20% of their income per annum, whereas, most American consumers save only about 5% of their income each year. Second, each person should be a good steward of his or her resources. These key resources include stable personal relationships and frugal personal habits. In effect, frugal habits help ensure longer life longevity, better compound time, and greater compound interest. Third, it is important for most wage-earners to develop multiple streams of passive income. Fiscal discipline contributes to effective investments in small and profitable value stocks with conservative capital investment growth and low market risk exposure.

Most self-made millionaires share the basic fact that they need no budgets. These millionaires spend relatively little in comparison to their disposable income due to their fiscal discipline and self-control. As a result, this frugal habit renders budgets unnecessary.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2026-07-01 11:29:00 Wednesday ET

In recent years, higher American economic growth has been impressive both by historical standards and in comparison to the rest of the world. American excep

2018-02-15 07:43:00 Thursday ET

Fed minutes reflect gradual interest rate normalization in response to high inflation risk. FOMC members revise up the economic projections made at the Dece

2023-12-03 11:33:00 Sunday ET

Macro innovations and asset alphas show significant mutual causation. April 2023 This brief article draws from the recent research publicati

2017-12-14 12:41:00 Thursday ET

Federal Reserve raises the interest rate by 25 basis points to the target range of 1.25% to 1.5% as FOMC members revise up their GDP estimate from 2% to 2.5

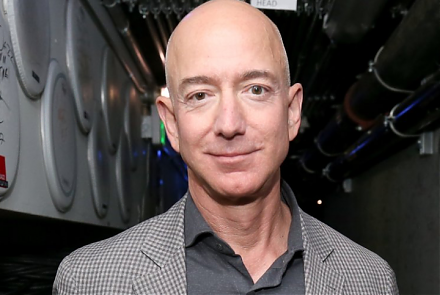

2019-04-17 11:34:00 Wednesday ET

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2020-02-19 14:35:00 Wednesday ET

The U.S. bank oligarchy has become bigger, more profitable, and more resistant to public regulation after the global financial crisis. Simon Johnson and