Home > Library > Credit default swaps and interest rate innovations

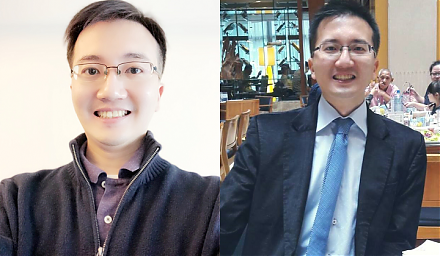

Author Andy Yeh Alpha

This research article empirically shows the mysterious and inexorable nexus between credit default swap spreads and interest rate surprises.

Description:

This paper examines the empirical relationship between credit risk and interest rate risk. We use the credit default swap (CDS) spread as our measure of credit risk. Also, we control for the variation in the fair-value spread that combines multiple sources of default risk, including the market price of risk (Sharpe ratio), the loss given default (LGD), and the expected default frequency (EDF). After taking into account the fair-value spread, a liquidity risk factor, and several proxies for the general state of the macroeconomy, we find that the interest rate surprise factor serves as a robust determinant of CDS spread gyrations in both the full sample and most subsamples organized by industry type and credit rating status. Furthermore, we empirically find that the swap interest rate variables convey material information about CDS spread movements above and beyond the Treasury interest rate variables in the vast majority of 2SLS regressions. These empirical results have important implications for the parameterization of interest rate dynamics in the Monte Carlo simulation of economic capital for a typical bank's credit portfolio.

2019-06-25 10:34:00 Tuesday ET

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the a

2017-07-07 10:33:00 Friday ET

Warren Buffett invests in American stocks across numerous industries such as energy, air transport, finance, technology, retail provision, and so forth.

2018-04-07 09:36:00 Saturday ET

Facebook CEO Mark Zuckerberg testifies in Congress to rise up to the challenge of public outrage in response to the Cambridge Analytica data debacle and use

2020-11-22 11:30:00 Sunday ET

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2018-09-21 09:41:00 Friday ET

Former World Bank and IMF chief advisor Anne Krueger explains why the Trump administration's current tariff tactics undermine the multilateral global tr

2018-04-26 07:37:00 Thursday ET

Credit supply growth drives business cycle fluctuations and often sows the seeds of their own subsequent destruction. The global financial crisis from 2008